Crypto Assets Continue Their Push Higher After A Solid 2023 Performance

It has been a hell of a year for crypto assets. We will break down some of the biggest moves and key highlights in these last two newsletters of the year. For a more crypto-native version of 2023, we recommend this absurd meme-filled video that highlights some of the silliest and most notable events in crypto.

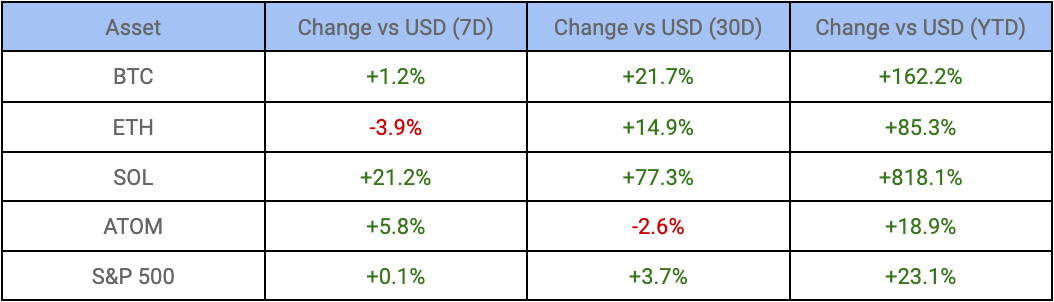

It is undeniable that crypto assets have had a good run in 2023. The one caveat may be that 2022 was an absolutely devastating year for crypto, and thus provides a charitable starting point for YTD gains. Despite this, it is hard to argue with the YTD returns on a number of key crypto assets.

Bitcoin: +155% YTD Return, 853 Billion Market Cap

Figure 1. Bitcoin had a good bounce back in 2023.

Bitcoin, the original cryptocurrency, has had an excellent year, rising +155% as of the time of writing. This, of course, comes off a difficult 2022, when Bitcoin was down -65% and when the entire crypto industry faced a seemingly endless onslaught of bankruptcies, frauds and “rug pulls”. 2023 has been marked with endless turmoil, though not quite as dire as last year. Bitcoin has had to face down the challenge of relentless SEC enforcement actions, the looming prospect of Mt Gox coins being distributed, a powerful anti-crypto push by the likes of US Senator Elizabeth Warren and the continued fallout from the crypto bankruptcy class of 2023 (3 Arrows Capital, Celsius, Voyager, etc). These challenges were somewhat counter-balanced by an unlikely ally in the form of Larry Fink and Blackrock’s plans for a spot Bitcoin ETF, an improvement in global liquidity, a rising tech sector and falling global interest rates.

Apart from Blackrock’s implicit endorsement, there were also a number of interesting developments that have helped to position Bitcoin as a viable and perhaps even respectable alternative macro asset. This was helped by the election of Javier Milei and his pledge to introduce radical economic reforms in Argentina and embrace crypto assets. This makes Argentina the second sovereign country to have embraced Bitcoin, after El Salvador did so last year. Overall, 2023 has been a great comeback season for Bitcoin after a devastating bear market.

Ether: +72% YTD Return, $266 Billion market cap

Figure 2. Ether is up over 70%, but has been a relative disappointment this year.

Ether, the second biggest crypto asset by market capitalization, has had a rather disappointing year relative to its peers despite rising over 70% YTD. In previous cycles, during the earlier stages of an uptrend, Ether would often lag behind Bitcoin along with the rest of the alt-coins as Bitcoin stole momentum away from the rest of the market. This cycle stands out, however, as alt-coins have also had a particularly good year along with Bitcoin. Angel investor Darryle Wang made the argument on a recent podcast that Bitcoin has become large enough of an asset by market capitalization with deep liquidity that it has become an investable asset for institutional investors. Meanwhile, Ether has yet to mature to this level and is too far up the risk curve for institutional flows. For retail and crypto-native investors, however, Ether has become too large and isn't likely to see the same returns as small-cap alt-coins. This leaves Ether in an awkward position in the market and with a Bitcoin ETF likely around the corner, it has experienced lacklustre inflows. The sentiment on Ether is likely the lowest it has been in years, becoming a running joke on crypto-twitter. Despite its underperformance, the fundamentals of Ether since The Merge have never been stronger. It remains the only ‘profitable’ protocol in the ecosystem, generating 2.3B in revenue this year.

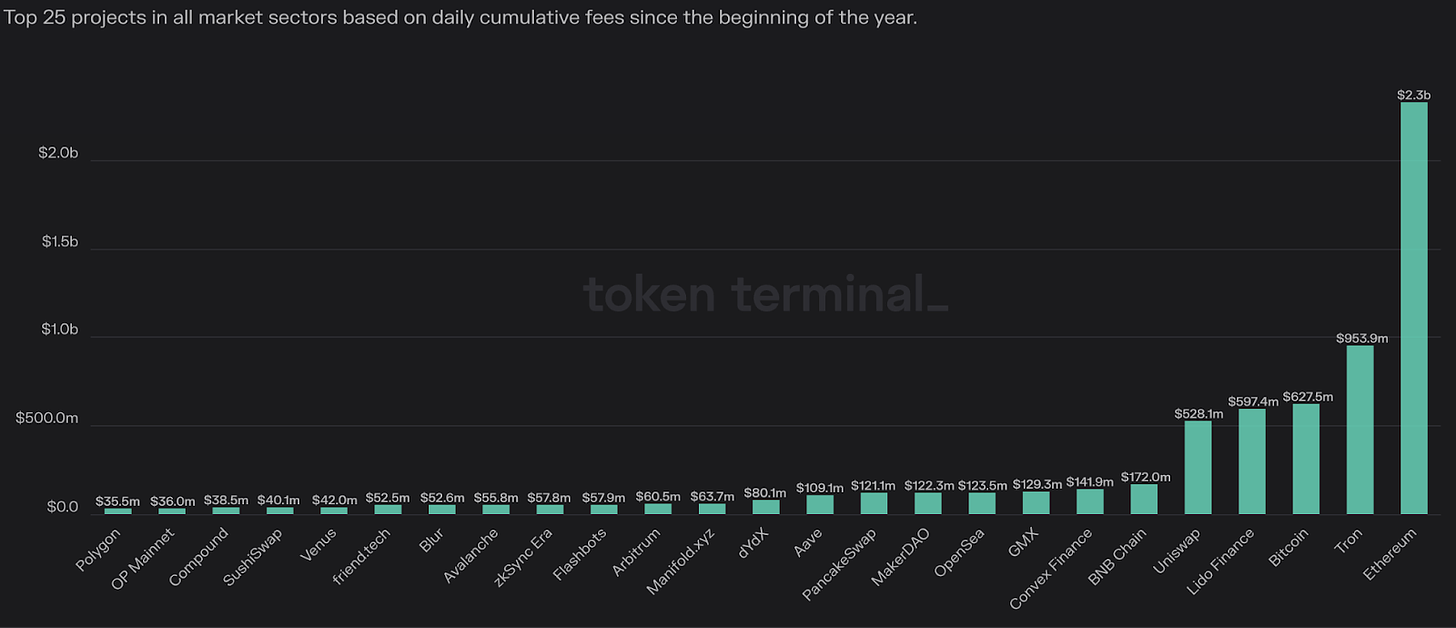

Figure 3. Ethereum protocol generates more fees than any other crypto protocol or application.

Since EIP-1559 and The Merge, about 70% of fees paid in Ether are ‘burned’ (permanently removed from the supply) while the rest accrue to token holders via its proof-of-stake consensus mechanism (staked Ether is currently yielding 4%). This has resulted in a deflationary supply of Ether. Ethereum also continues to dominate other alternative layer-1 protocols by almost all other metrics (total-value locked, on-chain volumes, active users, dex volumes). If on-chain activity continues or accelerates and the market re-focuses its attention away from Bitcoin post-ETF approval onto the multiple Ether ETFs that have been filed with the SEC, we expect Ether to begin to outperform Bitcoin next year. Ethereum developers also have a number of important upgrades coming up in the new year.

Figure 4. Due to a reduction in supply issuance and fee burning, Ether’s supply is deflationary.

Solana: +512% YTD Return, $38 Billion market cap

Figure 5. Solana has been in a strong uptrend that has accelerated into the year's end.

One of the biggest winners of 2023 has been Solana, an alternative layer-1 that is viewed as a direct competitor to Ethereum. Solana has become increasingly popular due to its lower gas fees and faster settlement times, which enable applications that aren’t possible on Ethereum, like derivatives exchanges with a centralized limit order book versus an AMM pool. Solana had a particularly difficult bear market as it was strongly associated with FTX’s Sam Bankman Fried, who was an investor and proponent of the protocol. Solana had suffered a ~95% drawdown from its peak in 2021. Throughout this year, FTX debtors have been selling off all remaining assets to try to make creditors whole, which included a sizable amount of Solana tokens. Despite this sell pressure, Solana has risen from the ashes and has become a top-returning asset this year. Many users have opted for Solana over Ethereum due to cheaper fees, while several exciting projects built on Solana in the Defi, NFT, and DePIN sectors have seen improved usage and adoption.

Total Crypto Market Cap: +100% YTD Return, $1.6 Trillion market cap

Figure 2. The dollar had a pullback into support after this week's FOMC meeting.

The total crypto market capitalization, which adds up the value of all crypto assets together, has risen approximately 100% YTD, from $750 billion to $1.6 trillion. The scope of the move is quite remarkable if you consider the fact that Bitcoin’s present market capitalization is 13% higher than the entire market was worth at the end of 2023. As the year comes to a close, sentiment in the crypto market has dramatically improved compared to that of 2022. With the ETF approval likely in January, we expect that Bitcoin’s upside will be limited in the short term as traders derisk into and after the event. Investors will likely then begin to closely monitor how much capital will flow into the first US-based crypto spot ETF and trade accordingly.

Latest Crypto Developments

In this section, we highlight the latest developments that may be significant in either the price action or the trajectory of the crypto space overall.

Tether, the company behind the USDT stablecoin, has enhanced its security measures by collaborating with U.S. law enforcement agencies. In a recent letter to U.S. legislators, Tether's CEO Paolo Ardoino outlined the company's efforts to prevent misuse of its stablecoins, including onboarding the Secret Service and FBI to its platform. Tether has proactively frozen wallets on the U.S. sanctions list and claims to have helped freeze 326 wallets controlling 435 million USDT in collaboration with the Department of Justice, Secret Service, and FBI. This initiative is part of Tether's commitment to security and working closely with law enforcement to ensure the responsible use of its tokens.

Coinbase, along with other crypto industry leaders like Kraken, Ripple, and Andreessen Horowitz, has raised and donated $78 million to support "pro-innovation" political candidates in the 2024 elections. This funding, channelled through a crypto-centric political action committee called Fairshake, aims to influence the election of candidates and the enactment of crypto-friendly policies. The crypto industry's lobbying efforts have increased significantly, with top spenders like Coinbase and Binance focusing on influential lawmakers. The industry's legislative efforts are particularly crucial as it faces major challenges in 2024, including bills to regulate stablecoins and the broader crypto sector at the federal level.

UK Finance Minister Jeremy Hunt has agreed to investigate the challenges licensed crypto firms face in opening business accounts in the UK. This decision follows a question raised by Lisa Cameron, Chair of the Crypto and Digital Assets All-Party Parliamentary Group, about the difficulties these firms encounter. Hunt's response indicates a commitment to ensuring the UK, particularly London, remains a global crypto hub. The UK government has introduced legislation for stablecoins and the promotion of crypto services, aiming to regulate the crypto market responsibly. This move is part of the UK's broader strategy to become a global crypto hub, which includes new regulations for supervising the nation’s Digital Securities Sandbox initiative, set to come into force in January 2024.

Epic Games has made a significant policy change by deciding to list "Adults Only" rated games on its online store if the rating is due to the use of blockchain technology. This decision allows blockchain games like "Gods Unchained" and "Striker Manager 3" to return to the Epic Games Store, despite their "Adults Only" rating. The move is seen as a step towards mainstream acceptance and adoption of web3 gaming, which has faced resistance from the traditional gaming industry. The Entertainment Software Rating Board (ESRB) clarified that blockchain-enabled games do not automatically require an "Adults Only" rating, and it depends on how the blockchain feature is implemented in the game. This development is significant for the blockchain gaming sector, which is still in its infancy compared to traditional gaming and has been working to overcome reputational challenges.

Market Returns

That's Some Good Content!

Recommended articles, podcasts, and other content from this week:

The Breakdown podcast - The Crypto Army Rallies!

Crypto Market Wizards podcast - 0xWangarian (EP9)

On The Brink podcast - Dan Tapiero (1RT Partners) 2023 Market Recap

Galaxy Brains podcast - Do You Own Your Crypto? w/ Sam Abbassi

Meme Of The Week