US Elections Creates Uncertainty for Crypto And New Documentary Says They Found Satoshi

Market Update

Crypto markets have entered a holding pattern as we approach the all-important US Presidential election on Tuesday, November 5th. While it does make sense for markets to enter into a bit of a lul as participants stay sidelined during this uncertain period, any unexpected development before November 5th could lead to a spike in volatility.

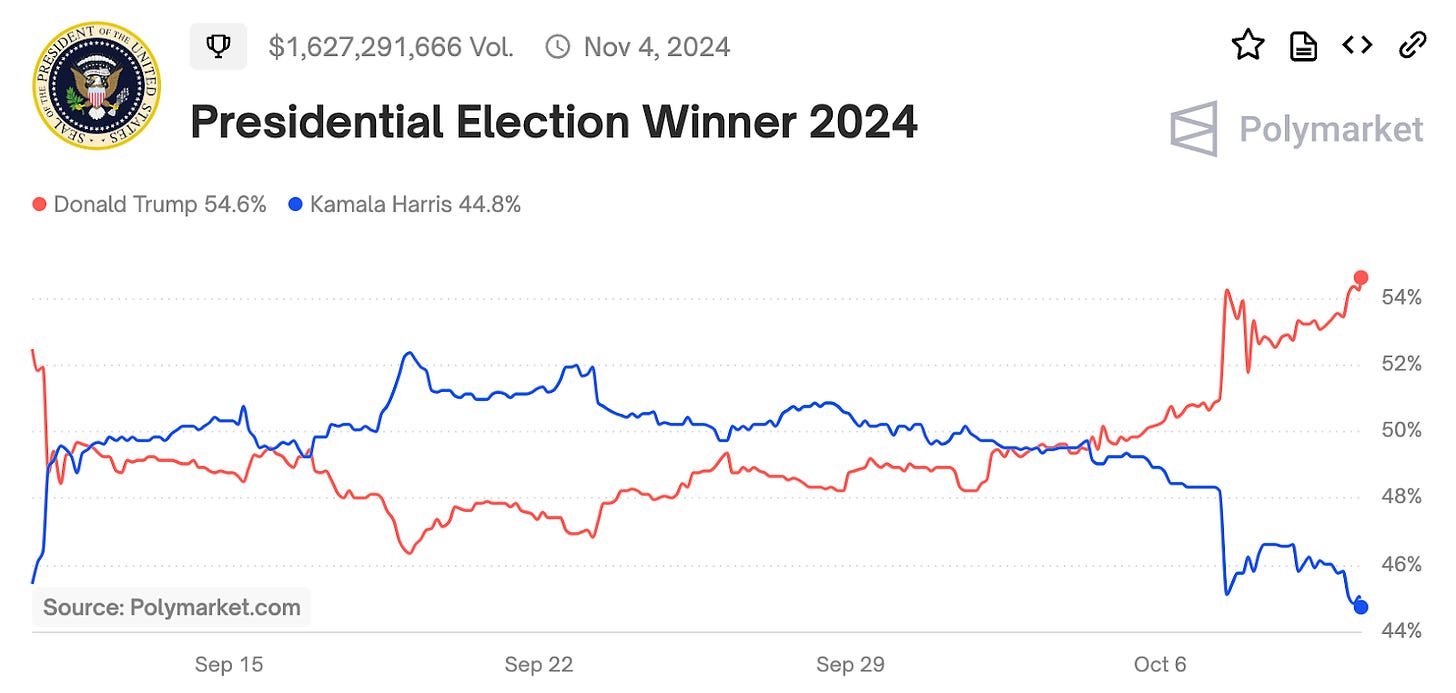

One thing to watch out for is any type of “October Surprise” coming from either the Democratic or Republican camps. During past elections, developments such as the Access Hollywood tape, the Hunter Biden’s laptop story and other last-minute maneuvers that political operatives had been saving to release weeks before the election in order to maximize the impact of such news. Any such developments that appear to help Donald Trump’s chances could be positive for crypto assets, with the inverse also true. As things stand, betting markets are giving Donald Trump a small lead, although it is still a very tight race.

Figure 1. Bitcoin has been chopping around rather uneventfully over recent weeks.

Barring any major October Surprise or perhaps dramatic developments coming from the geopolitical front, Bitcoin appears to be comfortable trading within its now well-defined price range. Investors should watch for any dramatic moves below $52K or above $72K. One possible catalyst that could cause significant downside in the near-term are the rumours that the US government may be poised to start selling more of its Bitcoin holdings. This comes after the US Supreme Court declined to consider a claim by a firm called Battle Born Investments that it had purchased the 69,370 Bitcoin (worth over $4 billion) that the US government seized from Silk Road. This decision could clear the way for the US government to start selling these coins.

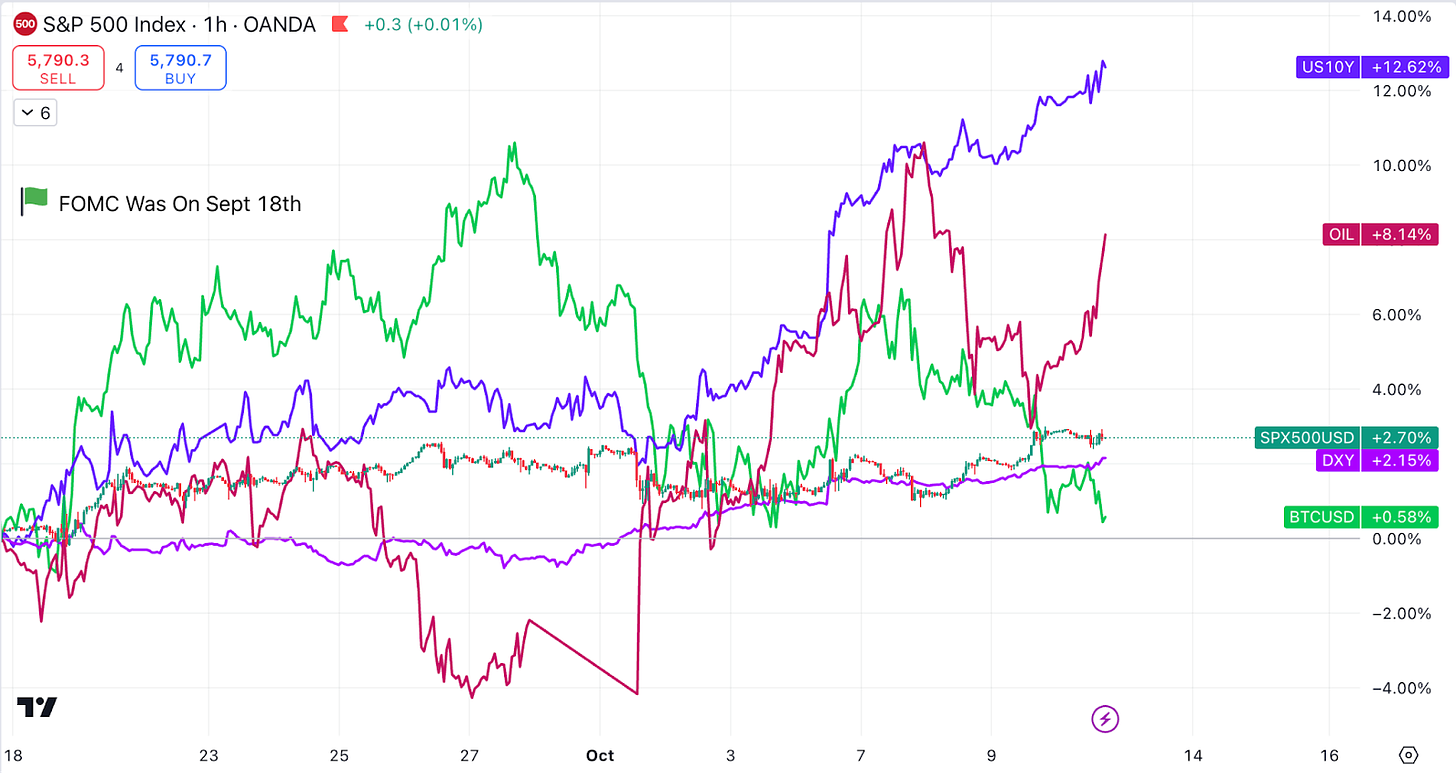

Figure 2. Some interesting post-FOMC price action with the US dollar (DXY) index up over 2%.

Meanwhile, the US dollar has continued to rise, while US 10-year yields are also rising, now above 4.1% (up 12% since the FOMC). Some traders are alarmed by this somewhat unusual situation. Many expected to see a lower US dollar and falling interest rates after the US Fed cut interest rates by 50 bps, roughly 3 weeks ago. One possible explanation is that with the Fed having gone with the somewhat unexpected 50bps rate cut to get ahead of the curve, the market might be pricing in a slower rate cut than expected, especially if job numbers continue to look robust. Meanwhile, with Oil above $80, tensions in the Middle East and the S&P 500 hitting all-time highs, it feels as though we are bracing for the next shoe to drop.

Markets and investors often crave one thing above all else - clarity. Until and unless we receive some breaking news that could help lock in one of the two US presidential candidates, it is unlikely that we see any renewed momentum in crypto over the coming weeks. For now, we must wait for November 5th.

US CPI Data Comes in Hot!

The latest Consumer Price Index (CPI) report shows a slight increase in inflation, with both headline and core inflation coming in higher than expected. This marks the first increase in core CPI data since early 2023.

Headline CPI rose 2.4% year-over-year, slightly above the forecast of 2.3%.

Monthly CPI increased by 0.2%, above the expected 0.1%.

Core CPI (excluding food and energy) remained at 3.3% year-over-year, with a monthly increase of 0.3%.

Shelter costs, which rose 0.5%, were a key driver of the higher-than-expected CPI.

The report caused stocks to dip, with the S&P 500 futures down 0.4% following the release.

U.S. Election Polling Update

The most important catalyst for the crypto markets remains the upcoming US election. Although Harris has softened her rhetoric towards the crypto industry, a Trump win would undoubtedly be seen as a bullish win for crypto. Although Trump has recently inched forward in some polls, the race has remained tight. Current polls show Kamala Harris has a slight national lead over Donald Trump, but swing states remain competitive.

National Averages: Harris leads by 2-3 points in major polls (FiveThirtyEight, RealClearPolitics, Silver Bulletin).

Key Polls: Harris leads 49% to 45% in the Economist/YouGov poll (Oct 9).

Swing States: Harris leads by 1 point overall in key battlegrounds, but Trump is ahead in Georgia.

State Polls: Trump leads by 13 points in Florida and 6 points in Texas (NYT poll).

FBI Creates Fake Crypto Project as Bait in Fraud Case, Charging 4 Companies, 14 Individuals

Federal prosecutors in Boston charged the individuals and crypto firms with a fraud scheme involving market manipulation and sham trading. The FBI created a bogus cryptocurrency, NexFundAI, on Ethereum and enlisted one of the firms as a market maker to help expose the fraudulent activities. The Attorney General said in a press release, "These are cases where an innovative technology—cryptocurrency—met a century-old scheme—the pump and dump.”

Firms charged: Gotbit, ZM Quant, CLS Global, and MyTrade were charged.

Defendants created fake crypto assets and inflated their prices through wash trading.

Over $25 million in cryptocurrency was seized, and four defendants have agreed to plead guilty.

The SEC filed civil charges against nine individuals and three firms for fraudulent market manipulation.

HBO Documentary Suggests Early Bitcoin Developer, Peter Todd is Satoshi Nakamoto

The HBO documentary Money Electric claims that Peter Todd is the pseudonymous creator of Bitcoin, Satoshi Nakamoto. Todd, however, quickly denied this online.

The documentary investigates various clues and focuses on Todd as the potential creator of Bitcoin.

Todd denied the claim on X (formerly Twitter), calling it baseless.

Evidence cited includes similarities in writing style and a 2010 forum post allegedly finished by Todd under Satoshi's name.

The documentary has sparked heated debate within the crypto community, with many dismissing the conclusion.

Former Bitcoin developer Gregory Maxwell pointed out flaws in the documentary’s theory, questioning its validity.

In response to the documentary, Bitcoin contributor Amir Taaki suggested that Satoshi Nakamoto's coding style—quirky, outdated, and highly personal—suggests an older individual, possibly from engineering or physics, rather than a traditional software developer like Todd.

Stripe Reinstates Crypto Payments for US Businesses

After a six-year hiatus, Stripe has reintroduced crypto payments for U.S. businesses, enabling merchants to accept USDC via Ethereum, Solana, and Polygon. Stripe is the second most used payment solution globally, behind PayPal and holds a global market share in the range of 17.4% to 21%.

Stripe first introduced bitcoin payments in 2014 but ended support in 2018 due to high fees and volatility.

U.S. businesses can now accept USDC payments from customers in over 150 countries, with merchants receiving dollars.

The integration supports various Stripe products, including checkout and payment intents, with more features coming soon.

Stripe previously expanded crypto services in the EU and partnered with Coinbase in June for crypto payouts.

That's Some Good Content!

Recommended articles, podcasts, and other content from this week:

L1 & L2 Token Value Capture blog by Jon Charbonneau

Blockworks opinion piece - The SEC has been wrong about ‘crypto asset securities’ all along

The Breakdown podcast - Did an HBO Documentary Just Reveal Satoshi's True Identity?

Empire podcast - Why Bandwidth is Still Undervalued in Crypto | Logan Jastremski

Hidden Forces podcast - Moving From an Income-Driven to a Credit-Driven Cycle | Bob Elliott

Meme Of The Week