Solana Soars At Eth’s Expense, Stripe Acquired Stablecoin Business For $1B And The World Awaits Nov 5th

Figure 1. Solana’s price action has been strong this week, breaking through $160.

Market Update

While Bitcoin has thus far been unable to overcome the crucial $70K resistance this week, the impressive rally in Solana has garnered the attention of many investors. Solana has finally been able to overcome the resistance levels at $160 and $170 this week, which have capped the price of the L1 “Eth Killer” since early August.

Figure 2. The price of SOL continues to outperform its competitor’s.

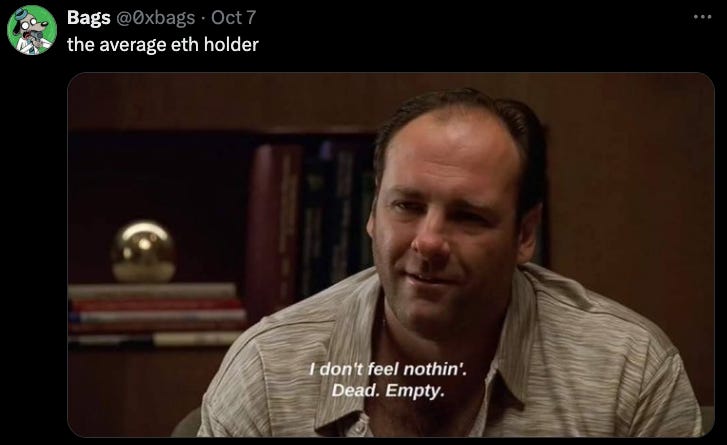

The breakout is occurring at a particularly painful point for Ether maxis, who have been languishing for over a year as their favourite coin, and #2 most valuable digital asset, underperforms its peers. Nowhere is this underperformance more obvious than the SOL/ETH chart (Figure 3). Perhaps more concerning than the price action is the general pessimism that surrounds Ethereum amongst crypto investors.

Figure 3. The SOL/ETH chart has reached a new all time high this week.

The disappointing ETF launches have been the latest in a string of let downs for the pioneer of smart contracts as higher-throughput blockchains such as Solana and Sui garner a greater share of on-chain transactions and capital inflows. Ether has been selling off considerably since the ETF launched in July and is only up +10% year-to-date, compared to Solana at +73% and SUI at +154%.

Figure 5. ETH price was rejected again at the $2,800 resistance level.

The pain can also be seen in the ETH/BTC chart, which is hitting a new low for 2024 at 0.037. There are a variety of arguments that try to explain this decline, including ETF outflows due to Grayscale’s Ether product, the parasitic nature of L2s that drain some of the economic benefits to Ether holders, the idea that the Ethereum foundation is “too woke” and not focused on what is best for Ether holders and the fact that higher through-put L1s are attracting far more new users and developers due to lower costs and ease of use. Whatever the reason, there is a need for Ether holders to find some signs of life from this asset, otherwise this trend has a chance to accelerate.

A seasoned investor may wonder whether all this doom and gloom, alongside the pathetic price action, could actually be a contrarian indicator that the bottom is in for Ether. Markets do love to beat up on assets until even the most faithful believers capitulate, before suddenly turning around. While this may in fact be the case for the OG of smart contracting, a turnaround is sorely needed in the not too distant future.

Figure 5. The ETH/BTC downtrend continues unabated.

Another major development this week has been the announcement of the $1 billion acquisition of Bridge, a stablecoin startup, by the payments giant Stripe. The purchase marks one of the biggest crypto startup acquisitions of all-time and could have a meaningful impact on the adoption of stablecoin payment solutions across the globe. Stablecoin use has accelerated dramatically over the past year in areas outside of crypto speculation and this move could significantly accelerate this trend.

With 12 days left before the US Presidential election, crypto investors are bracing for an uptick in volatility and uncertainty as early voting is well underway. Kamala Harris has been on a media blitz in an effort to shore up support amongst her base as political polls and betting markets signal that Trump appears to suddenly be the favourite to win the White House. Trump’s upcoming appearance on the Joe Rogan Podcast, which is expected to be released on Friday, could be an important event that could either solidify his position as the likely winner, or derail the momentum he has been enjoying for the past few weeks. Whatever happens on November 5th, this writer looks forward to having the election behind us so that investors can have some degree of certainty and can focus on the markets.

Crypto Super PAC Boosts Spending to Support Industry-Friendly Lawmakers

A recent article in Politico details how crypto-focused Super PAC Fairshake could successfully elect several lawmakers to the House and Senate across party lines, giving the industry a number of allies in DC.

The PAC is channeling funds into campaigns of candidates who have taken a pro-crypto stance, with the goal of shaping a regulatory environment conducive to the industry's growth.

The organization is targeting specific candidates who are vocal against restrictive regulations on crypto, prioritizing those with the potential to influence crypto policy significantly.

This financial backing is part of a broader push by crypto advocates to ensure that future legislation protects innovation and provides clarity rather than adding restrictive measures that could stifle industry growth.

The Super PAC aims to build a coalition of supportive lawmakers to counteract more skeptical regulatory approaches from certain segments of Congress.

BlackRock Seeks Bigger Foothold in Crypto Derivatives Market

BlackRock aims to expand the use of its BUIDL token as collateral in crypto derivatives trading, deepening its involvement in the crypto asset space.

BlackRock and Securitize are in discussions with major crypto exchanges, including Binance, OKX, and Deribit, to allow the use of BlackRock's BUIDL token as collateral for derivatives trades.

BUIDL is a tokenized money-market fund designed for institutional investors, with a minimum investment of $5 million, and offers interest to holders, differentiating it from stablecoins like Tether's USDT.

FalconX, Hidden Road, and custodian Komainu already accept BUIDL as collateral, with expansion to Binance and Deribit potentially broadening its usage.

BlackRock's initiative is a challenge to dominant stablecoins like USDT and Circle's USDC, which are commonly used for collateral in derivatives trading.

BUIDL currently has a total circulation of $550 million, while BlackRock charges a 0.5% management fee for the token.

The use of tokens like BUIDL as collateral aims to streamline transactions, potentially reducing risks during market stress by avoiding the need for traditional cash redemption processes.

The derivatives market remains a major segment of crypto

Federal Reserve's Christopher Waller Says DeFi Can Complement Centralized Financial Systems

Federal Reserve Governor Christopher Waller suggests that decentralized finance (DeFi) could complement traditional centralized financial systems if properly regulated.

Waller emphasizes the potential benefits of DeFi, such as improving efficiency and reducing transaction costs, particularly if it integrates well with existing financial infrastructure.

He acknowledges the challenges related to DeFi, including the need for regulation to manage risks like fraud, market manipulation, and financial stability concerns.

The comments reflect a growing acknowledgment by regulators that DeFi could play a significant role in enhancing the current financial system, rather than replacing it.

Waller sees a future where both decentralized and centralized systems coexist, provided DeFi platforms address current shortcomings and align with regulatory frameworks.

He also highlighted the role of innovation in making financial services more accessible and efficient, as long as proper safeguards are in place to protect consumers and maintain system integrity.

CFTC Chair Behnam Urges Congress to Act on Crypto and Election Betting Legislation

Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam is pressing Congress to take action on legislation concerning crypto and election betting. Polymarket is currently the largest crypto based predictions market in the world but actively blocks US residents from its platform due to regulatory concerns.

Behnam called on Congress to clarify regulatory oversight of the rapidly evolving crypto industry, emphasizing the importance of defining roles between the CFTC and the SEC to better protect investors.

He also highlighted the need for legislative action regarding election betting markets, which have grown in popularity but face legal ambiguity in the United States.

Behnam pointed out that regulatory clarity is crucial for establishing a safer and more transparent environment for market participants in both crypto and betting sectors.

The CFTC chair's push for Congressional action reflects ongoing efforts to provide a structured framework that can address both innovation and risk within these emerging financial markets.

That's Some Good Content!

Recommended articles, podcasts, and other content from this week:

Syncracy blog post - Applications Capture Fees, Blockchains Store Value

The Breakdown podcast - The Biggest Acquisition in Crypto History

Forward Guidance podcast - Breaking Down The Current Business Cycle | Eric Basmajian

Unchained podcast - The Chopping Block (feat. Anatoly): Solana's Second Act, SVM vs EVM, & Extension Dilemma

Meme Of The Week