Bitcoin Flirts With $70K Breakout, Fink Declares BTC A Standalone Asset And A Pre-Election “Trump Pump” Gets Underway Across Risk Assets

As American voters head to the polls to cast early ballots, there has been a surge in expectations of a Donald Trump victory in November. Market-oriented indicators, such as betting markets, risk assets and even the price of shares in Trump Media & Technology Group (ticker DJT), are signalling that investors are placing bets that Republicans will end up victorious on election day.

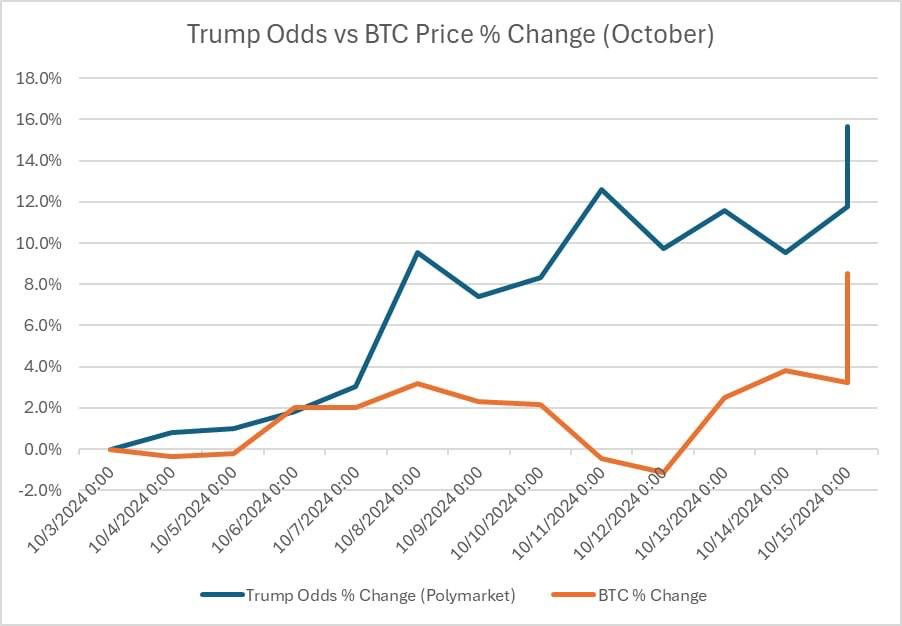

Figure 1. The market seems to be getting bullish on a Trump win.

The election outcome is important for investors on several fronts. For a great analysis of these implications for markets, we recommend this recent 20-minute interview with Stanley Druckenmiller. While signalling personal disgust with both candidates, Druckenmiller suggests that markets are betting on a Trump victory and that a Republican sweep across the board would be positive for risk assets in the near term.

Figure 2. Shifts in polling data favourable for Trump have helped push BTC higher.

As we have mentioned over the last few weeks, the stakes are particularly high for crypto markets. Not only has Trump been an open supporter of the crypto industry, which has been battered by anti-crypto Democrat policies, but he even launched his own Defi crypto token called World Liberty Financial this week, a move largely criticized by the crypto community. The recent surge in expectations for this pro-crypto candidate has helped crypto assets rally this week as Bitcoin appears poised to challenge the last few resistance levels around $68k -72K. Larry Fink also helped spur bullish crypto spirits by calling Bitcoin a standalone asset class during their recent Q3 earnings call.

Figure 3. After one of the lengthiest consolidations in BTC’s history, price is yet again pressing up against resistance.

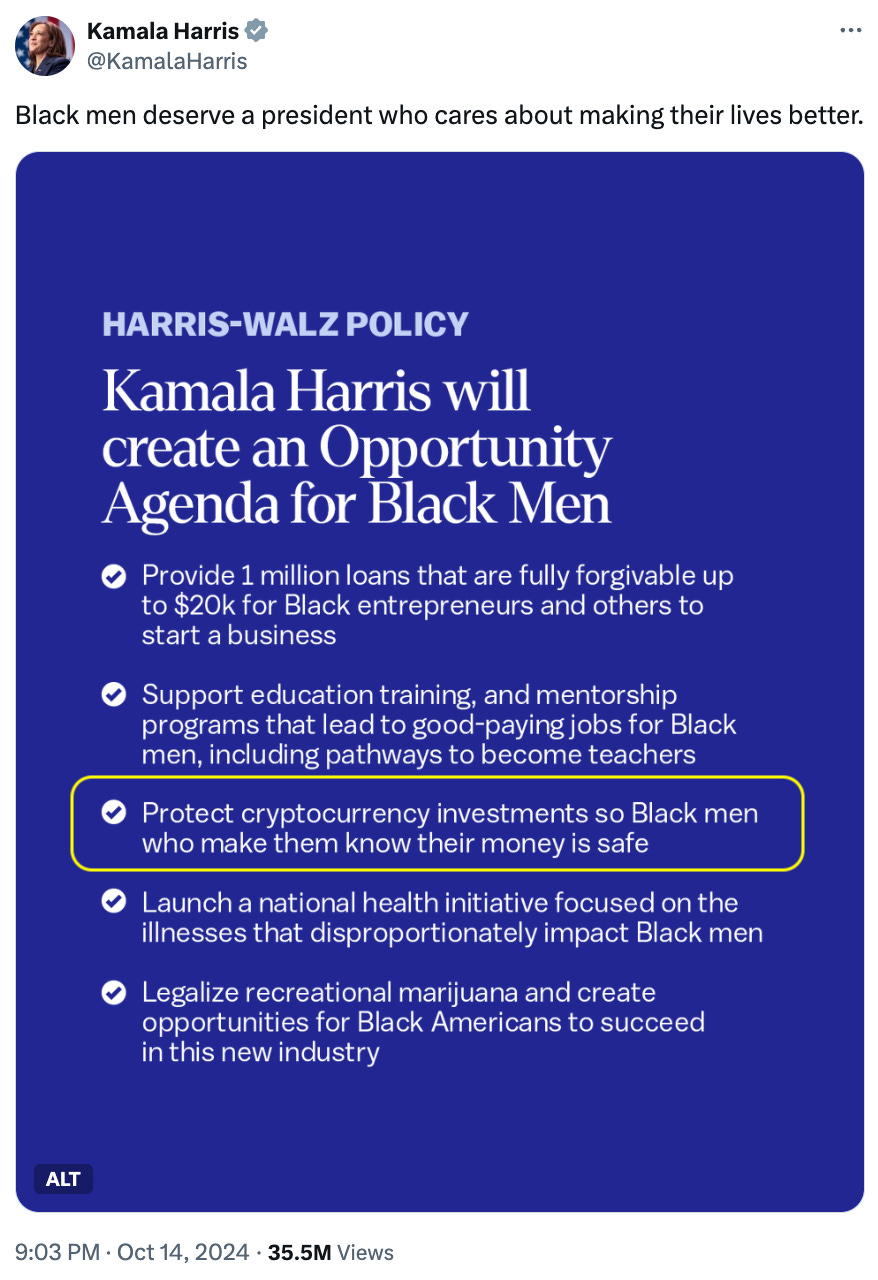

Meanwhile, Kamala Harris has unveiled some tentatively pro-crypto policies by stating in a post on X aimed at galvanizing support amongst Black male voters that she would “protect crypto currency investments so Black men who make them know their money is safe”. Putting aside the racial implications of this policy, it is unclear what she means by this tidbit of information. Her camp’s other efforts to reach out to the crypto industry have also delivered little in terms of what the practical impact of a Harris administration would be for crypto.

Figure 4. Harris’s pro-crypto mention has only created confusion and skepticism in the crypto space

If the 2016 election, when Donald Trump won the White House despite lagging dramatically in nearly every major political poll, is anything to go by, one shouldn’t presume any outcome at this stage. The race for the White House and the House of Representatives appears to be very close and many factors, such as candidate interviews, any final “October Surprises” and voter turnout, could still dramatically change the outcome of this important election.

As the major catalyst for the crypto markets remains a coin toss, BTC and ETH are pressing up against major levels while open interest and funding rates are heating up. One should assume the market will see increased volatility aided by cascading liquidations as we approach November 5th.

Figure 5. Aggregated open interest has chased Bitcoin’s price action since it bottomed in early August 2024.

Vitalik Buterin Lays Out Ethereum's Future Scalability: The Surge

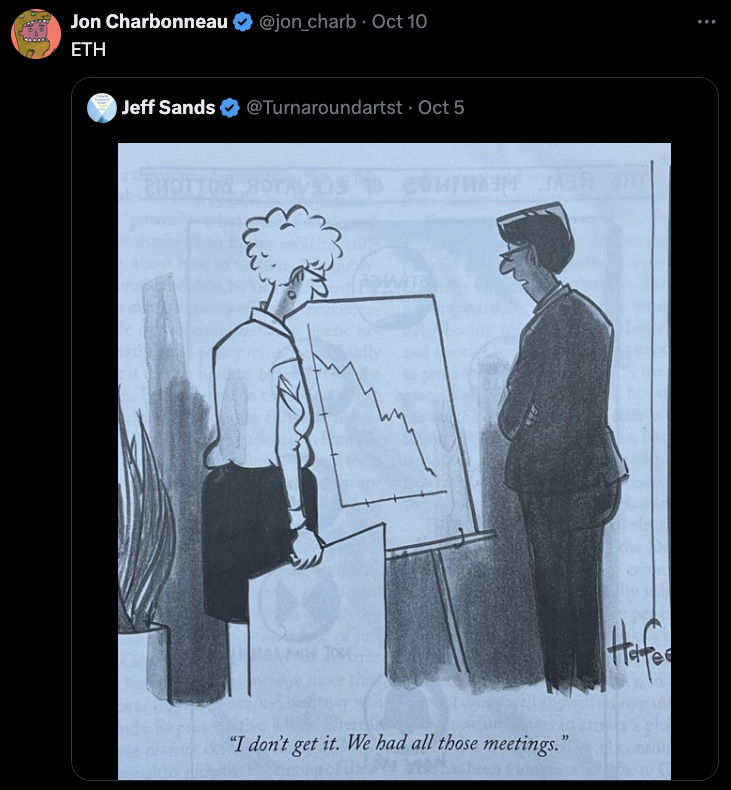

As Ethereum has become increasingly criticized for its layer-2 (L2) centric roadmap, Vitalik Buterin has become more vocal on Ethereum's path to achieving greater scalability. Faster and cheaper chains like Solana have begun to take market share away from Ethereum, while L2s have reduced validator revenues on Ethereum’s Layer-1 (L1) chain and have fragmented liquidity. In a blog post, “The Surge,” Buterin focuses on improving transaction throughput on the L1 while maintaining decentralization. Sentiment in the Ethereum community has turned increasingly negative as ETH has underperformed the broader market this year, and its fundamentals are being tested by competing L2s. Vitalik's renewed ambition to respond to criticisms could be a turning point for ETH if the community can rally behind a solution that addresses critics' concerns.

Buterins blog post lays out a plan to achieve 100,000+ TPS on the L1 and L2s.

Rollups and data availability sampling (DAS) are key to scaling, with some L2s fully inheriting Ethereum’s trustless properties.

Cross-L2 interoperability remains a major focus, ensuring Ethereum feels like one cohesive ecosystem.

Plasma and data compression are explored as ways to further scale execution and reduce transaction sizes.

Bitcoin ETFs Surpass $20 Billion in Net Flows

Bitcoin ETFs have crossed $20 billion in total net inflows, a significant milestone in the ETF world, following a massive $1.5 billion surge in a single week.

BlackRock’s IBIT led inflows with $393.4 million in one day.

Total assets in Bitcoin ETFs reached $65 billion, a new high.

Spot Ether ETFs rebounded, posting $24.22 million in net inflows.

Other major players like Fidelity and Bitwise also contributed to the surge.

A16z Publishes Their State of Crypto Report 2024

The 2024 State of Crypto Report highlights significant progress in the crypto landscape. The article suggests that crypto activity reached all-time highs, with 220 million active addresses in September. Analysts have pointed out that active addresses as a metric is problematic given the high number of automated bots on chains like Solana, which misrepresent organic growth. Despite this, the article does point to key developments in policy, technology, and other adoption metrics like stablecoin usage.

Stablecoins have gained product-market fit, supporting fast, low-cost global payments.

Crypto has become a key issue ahead of the U.S. election, especially in swing states.

Major infrastructure upgrades have reduced transaction costs and boosted scalability.

DeFi and AI integration continues to grow, along with new onchain applications like NFTs and social networks.

Stripe in Talks to Acquire Stablecoin Fintech Platform Bridge

Major payments processor Stripe is in advanced discussions to acquire Bridge, a fintech platform specializing in stablecoins, marking its continued move into the stablecoin space.

Bridge helps businesses issue, store, and accept stablecoins like USDT and USDC.

The acquisition would support Stripe’s recent expansion into stablecoin payments, following its reintroduction of USDC payments for U.S. businesses.

Bridge has raised $58 million, with Sequoia leading its latest $40 million Series A round.

The deal remains unconfirmed, with no final decision made by either party.

That's Some Good Content!

Recommended articles, podcasts, and other content from this week:

Unchained podcast - 2 Crypto Investors on Why They Believe DeFi Is Poised for a Bull Run

On The Margin podcast - The BTC/ETH ETF Flows Are Just Getting Started | Matt Hougan

Bankless podcast - A16z 2024 State of Crypto Report | Eddy Lazzarin & Daren Matsouka

Meme Of The Week